6 September 2024

By Roger Kennedy

roger@TheCork.ie

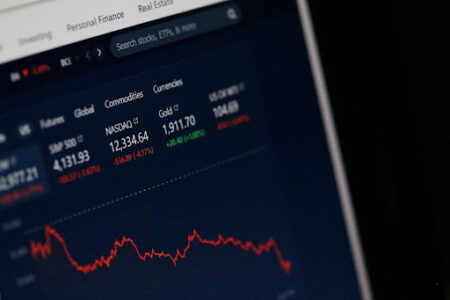

Trading is an exciting yet challenging endeavour, especially if you’re new to the financial markets. With platforms evolving and a challenging economic landscape in the UK, novice traders must have a solid foundation.

If you’re just starting out hoping to make more money to combat high inflation rates, here’s how to master the basics.

Understanding the basics

Before diving into the markets, it’s crucial to understand what trading entails. It involves buying and selling financial instruments, such as stocks, forex or cryptocurrencies, intending to make a profit. Each type of trading has its nuances: stock trading focuses on shares of companies, forex trading deals with currency pairs, and cryptocurrency trading involves digital assets like Bitcoin.

A critical part of getting started is familiarising yourself with essential concepts such as risk management, market analysis and the importance of setting realistic goals. Risk management is all about making calculated decisions to protect your investments, while market analysis—both technical and fundamental—helps you understand market trends and make informed trades.

For those beginning their journey, having access to the right tools is vital. Platforms like Tradu’s offer essential features that allow you to execute trades efficiently, ensuring security and access to various markets. By utilising these tools, you can start on the right foot.

Developing a trading strategy

One of the most common mistakes is jumping into trading without a well-defined strategy. A robust strategy is your roadmap to success as it will help you decide when to enter and exit trades.

Two main types of analysis underpin most strategies:

- Technical analysis: Involves studying charts and patterns

- Fundamental analysis: Considers economic indicators and company performance.

Managing risk

Effective risk management is vital if you’re going to successfully trade. Without it, even the most promising trades can lead to significant losses. One fundamental technique is setting stop-loss orders, which automatically closes a trade if the market moves against you by a specified amount. This helps to limit losses and protect your capital.

Another key aspect is position sizing, which refers to determining the amount of money to invest in a single trade. Beginners should avoid risking too much on any one trade and instead diversify their investments across different assets. Diversification helps to spread risk and reduce the impact of any single market movement.

Staying informed and adapting to market changes

The financial markets are dynamic. Staying informed is therefore crucial for making sound decisions. Keeping up with financial news, economic indicators and market trends can provide valuable insights. To do this, you should regularly read articles, attend webinars and even practice using demo accounts.

Final thoughts…

Trading offers the potential for substantial rewards, but it requires discipline and a robust strategy. By understanding the basics, managing risk effectively, and staying informed, even novices can set themselves up for long-term success.