30 March 2020

By Elaine Murphy

elaine@TheCork.ie

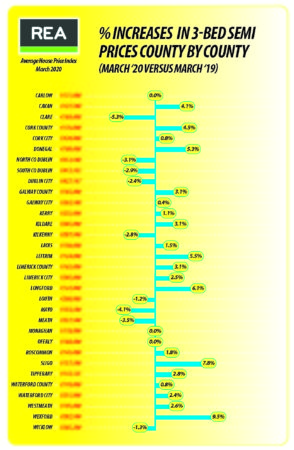

The price of the average three-bed semi in County Cork rose by 4.5% to €176,000 in the past year up the outbreak of Covid-19 according to a national survey carried out by Real Estate Alliance.

Average house prices in Charleville were unchanged this quarter at €154,000, and time to sell rose from six weeks to 10.

Bantry average three-bed semi prices have remained at €198,000 this quarter, but time taken to sell is now 18 weeks, a month longer than in the same period in 2019.

The price of the average three-bed semi in Cork city rose by 0.8% to €320,000 in the past year, but remained unchanged over the past three months, with the average house taking 12 weeks to sell.

The Q1 REA Average House Price Survey concentrates on the actual sale price of Ireland’s typical stock home, the three-bed semi.

It gives an accurate picture of the second-hand property market in towns and cities countrywide to the start of the current crisis, which has seen a sudden slowdown in activity according to REA.

Average house prices nationally returned to growth with an increase in activity in the first three months of the year up the outbreak of Covid-19.

The price of a three-bedroomed semi-detached house across the country rose by 0.14% over the past three months to €235,028, after an annual decline of 0.63% in 2019.

“There is no doubt that we saw a stronger market in Q1 up to the start of the current health crisis, with increased first-time buyer activity and higher transaction levels than in the second half of 2019,” said REA spokesperson Barry McDonald.

“We are suddenly in a time of uncertainty, and a pause button has been pressed on activity, but the fundamental issue of a lack of supply remains.

“The recent State interventions are welcome in providing increasing levels of security and certainty to loan-approved buyers.

“Many of our agents are accelerating the move to virtual viewings and online selling methods as the market adapts to the Covid-19 restrictions.

“We are in a different place than in 2008, and we will benefit from the effects that the Central Bank’s lending restrictions have had on a market that has experienced conservative rather than rapid growth over the past seven years.

“We also don’t have the huge amount of small-time investors that we saw in the crash as they have left the market in an orderly fashion over the past few years.

“There is unity in the country, the State and the banks are working together to support homeowners, and buyers will have a lot of time to make decisions in the coming weeks and months.”