9 April 2021

By Elaine Murphy

elaine@TheCork.ie

Median asking price for a property in the county now at €249,250

Property prices in Cork have fallen marginally by €750 during the quarter, according to the latest MyHome.ie Property Report.

The report for Q1 2021 shows that the median asking price for a property in the county is now €249,250. This represents an increase of €4,250 compared to this time last year.

Continuing this trend, asking prices for a 3-bed semi-detached house in the county fell by just €5 over the quarter, from €245,000 to €244,995. Prices for this house type are up by €4,995 compared to Q1 2020.

Meanwhile, the asking price for a 4-bed semi-detached house in Cork fell by €10,000 over the quarter, from €320,000 to €310,000. This means house prices in the segment have risen by €15,000 compared to this time last year.

The number of properties for sale in Cork on MyHome.ie fell by 6% in the last quarter and was down 13.5% on this time last year. In the city, the number of properties for sale fell by 7% over the quarter and by 14% compared to Q1 2020.

The average time for a property to go sale agreed in the county after being placed up for sale now stands at nearly seven months. In the city, it is nearly five months.

National picture

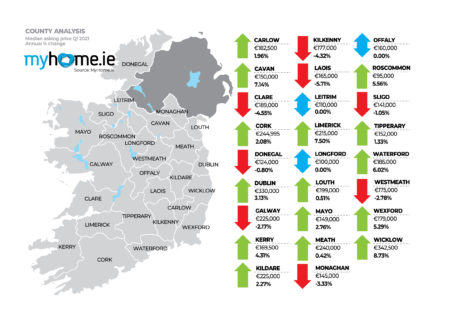

The report found that annual asking price inflation rose by 4.2% nationwide, by 4.1% in Dublin and by 4.8% elsewhere around the country.

Meanwhile, quarterly asking price inflation was flat – at 0% nationally, while increasing by 1% in Dublin, and falling by 0.4% elsewhere around the country.

The author of the report, Conall MacCoille, Chief Economist at Davy, said that a striking feature of the report was how housing market activity had persevered through the third lockdown. “Remarkably, new listings for sale in the first quarter were down only 30% compared with 2020 versus 80-90% annual falls during the first lockdown.

“All the data suggests that housing market activity should bounce back rapidly once the restrictions are lifted. Mortgage approvals in January were up 12% on the year, with the average approval up 8% to a fresh cyclical high of €256,000. So, there is no evidence of tightening credit conditions holding back homebuyers.”

Angela Keegan, Managing Director of MyHome.ie, said that interest in the property market was at a historic high and as such it was imperative that the supply issue be dealt with. “Traffic through the MyHome.ie website is up 13-30% on different metrics, such as users, sessions and page views. As such, it is crucial that the construction sector be allowed to return to normal activity in order to address this obvious demand and safeguard the market as we emerge from Covid.”

Full details of the report can be found at www.myhome.ie/reports