5 January 2021

By Tom Collins

tom@TheCork.ie

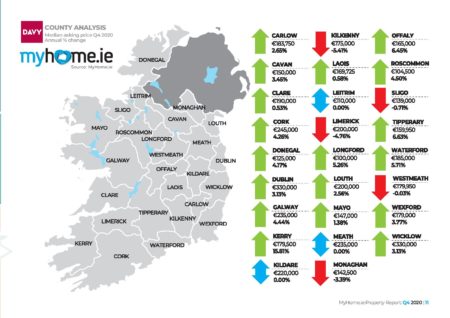

Property prices in Cork have remained unchanged during the quarter, according to the latest MyHome.ie Property Report in association with Davy.

The report for Q4 2020 shows that the median asking price for a property in the county is still €250,000. This represents an increase of €5,000 compared to this time last year when the median price was €245,000.

However, the asking price for a 3-bed semi-detached house in the county decreased by €2,500 over the quarter, and is now €245,000. This represents an increase of €10,000 compared to this time last year.

Meanwhile, the asking price for a 4-bed semi-detached house in Cork rose by €20,000 over the quarter to €320,000. This means prices in the segment were up €25,000 compared to this time last year.

The number of properties for sale in Cork on MyHome.ie decreased 5% in the last quarter and was down 15% on this time last year. In the city, meanwhile, the number of properties for sale fell by 1% over the quarter and by 16% compared to this time last year.

The average time for a property to go sale agreed in the county after being placed up for sale now stands at nearly six months. In the city, it is nearly four and a half months.

National picture

The author of the report, Conall MacCoille, Chief Economist at Davy, said that house price increases were now likely in 2021. “This quarter’s MyHome report points to an acceleration in annual asking price inflation to 6%, the fastest pace in almost three years. This pressure has not yet turned up in transaction prices, although the Central Statistics Office (CSO) Residential Property Price Index (RPPI) rose by 0.5% in October, the sharpest monthly increase in over one year. It is probably only a matter of time before the official measure of house price inflation accelerates.

“As we head into 2021, homebuyers have saved additional funds to purchase homes, with sentiment helped by the likely recovery in the economy as vaccines are disbursed. Given that homebuilding will remain impaired, with banks seeking lending opportunities, too much cash is chasing too few homes – which can only push prices higher.”

Angela Keegan, Managing Director of MyHome.ie, said: “The property market mirrors the overall economy, and we are in a much better place now than we may have expected to be earlier in the year when the virus emerged. Government Covid-19 supports, increased mortgage lending, and the concentration of job losses among mostly lower-paid workers have ensured the property market has remained buoyant, while the ongoing issue of supply has exacerbated demand leading to a rise in house price inflation.”

Full details of the report can be found at www.myhome.ie/reports